How to Budget More Effectively Using Modern Fintech Tools

If you’re looking to budget more efficiently in the US, you may be doing most of your spending between the 15th and the 30th each month. You get paid around those two dates, and your bills are due on the 1st of the following month.

Improving your financial situations is all about stretching each dollar as far as it can go.

On that front, Kasheesh provides a genuinely flexible combination of credit and debit, so budgeting is more sustainable. That means we’ll:

- Help you avoid ultra-low balances in your bank account by making sure you don’t have to drain your debit card to make a purchase

- Make sure you don’t have to turn to maxing out credit cards either

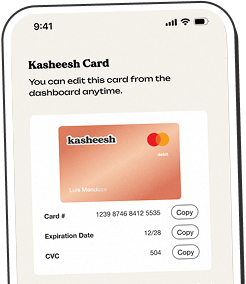

Kasheesh gives you the flexibility to choose how much you want to spend on each card. This improves your finances and provides just a bit more wiggle room in your spending.

That’s because you can truly stretch your dollars as far as possible between the 15th and 30th.

As a result, you’ll get marginal savings and healthier credit card balances, which improve credit scores and empower you on your personalized financial journey.

Everyone’s finances are different.

A tool like Kasheesh works for you instead of forcing you into one blanket system.

Kasheesh allows for a truly flexible system where customers can integrate debit with credit. That way, they're budgeting in a more sustainable fashion.

Disclosure: Kasheesh is a financial technology company, not a bank. Banking services provided by Bangor Savings Bank, Member FDIC. Kasheesh's Mastercard® Pre-paid and debit cards are issued by Bangor Savings Bank, Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circle design is a trademark of Mastercard International Incorporated. Spend anywhere Mastercard is accepted.

The content on this blog is for general information purposes only, and is not intended to be personal financial advice. It does not take your individual circumstances and financial situation into account, and any reliance you place on the information is at your own risk.

.png)

.png)