If you’re not well-informed about credit utilization rates, that can slow you down on your journey toward a better credit score.

The definition of your “utilization rate” is the ratio of how much you owe on all of your revolving accounts vs. your total available credit.

Many consumers don’t truly understand the implications of that ratio and how it impacts their credit scores and finances. They assume that if they complete their monthly minimum payment, they’re doing enough.

However, reporting companies like FICO and TransUnion also focus on that utilization rate.

If you keep carrying outstanding balances from month to month, never quite lowering that total amount owed, your utilization rate remains too high.

This harms your credit score pretty notably, which can gradually drop over time. That makes it difficult for people with lower scores to:

- Get new credit cards

- Access loan opportunities

- Open high-yield interest accounts

Understanding Interest and “Buy Now, Pay Later”

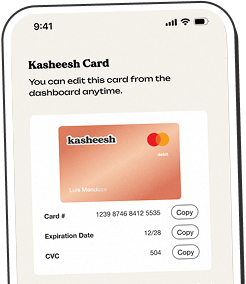

Since Kasheesh focuses on making spending less painful with every transaction, we learned why “buy now, pay later” (BNPL) was huge for people’s financial behavior.

Nowadays, we’re used to getting to the checkout page and seeing alternative spending options, rather than just plugging in a debit or credit card. We’ve realized that different financing options suit different types of purchases.

Unfortunately, the shift toward options like BNPL came with problems like:

- Hidden fees

- False advertising about 0% interest rates

- Additional costs associated with purchases that can reach 36% APR

It’s a type of predatory lending – giving loans to people who don’t fully understand the terms of that loan.

That’s why it’s essential to understand what interest is and how it impacts you individually.

At the end of the day, credit cards are just loans in card form, not cash in your bank account.

So, not considering the interest on your credit card from day one is a major (but common) mistake.

That’s why we’ve seen so many customers who are disillusioned with credit cards and looking toward alternative financing to meet their needs.

A Flood of BNPL Options (And What You Need to Know)

When BNPL went mainstream, it received massive consumer demand. Its financial flexibility was hugely helpful, but that intense demand led to market saturation.

Tons of solutions cropped up. So, BNPL as an industry lowered their FICO threshold.

That led to a high-delinquency market, meaning many of these loans were late to be paid back.

To make up for that money shortfall, interest rates went up — from that original, incredible promise of 0%. Hidden fees and costs also cropped up to try and fill that gap.

Even if BNPL shouldn’t be used to buy $5 in snacks at Whole Foods, it's available.

The lesson is: If you use a financial system without educating yourself, you may get preyed on in the long run — even if that’s due to market conditions that are out of your control.

What we’re seeing right now is a lot of consumers needing to play catch-up in getting up to speed on how interest and lending work.”

.png)

.png)